Ideal Info About Small Business Tax Deductions Spreadsheet

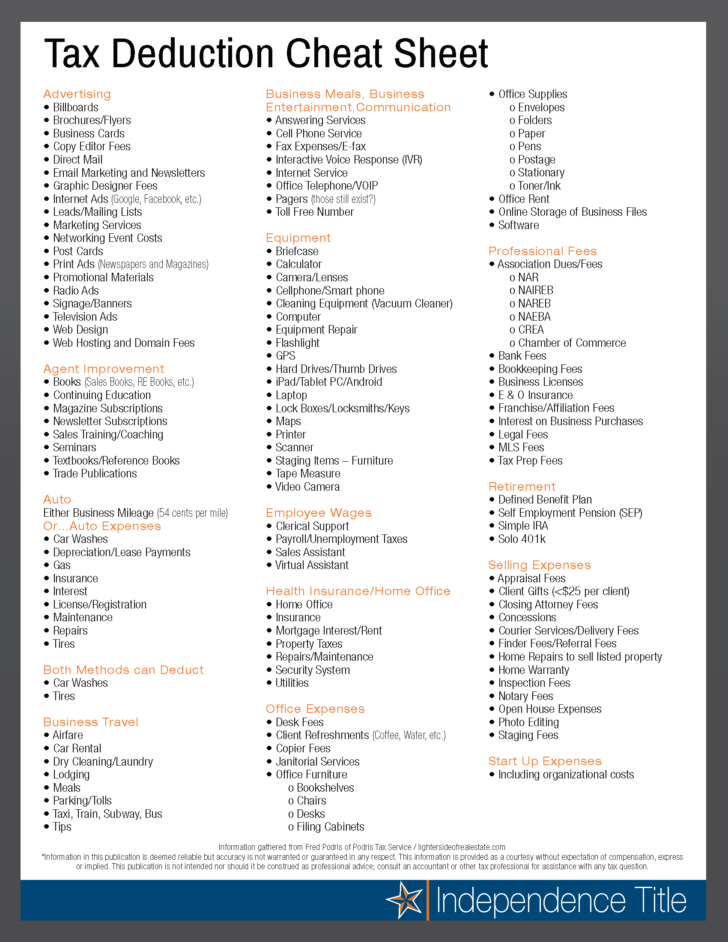

The irs offers two ways in which business owners can deduct for company travel using one’s own vehicle.

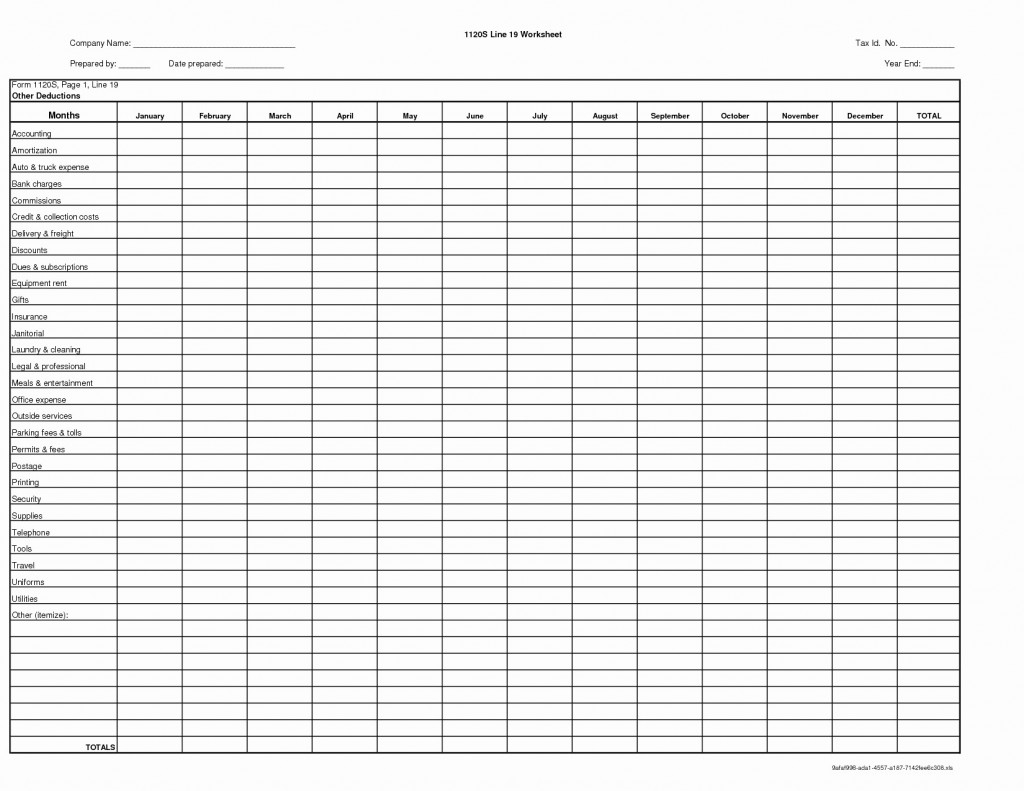

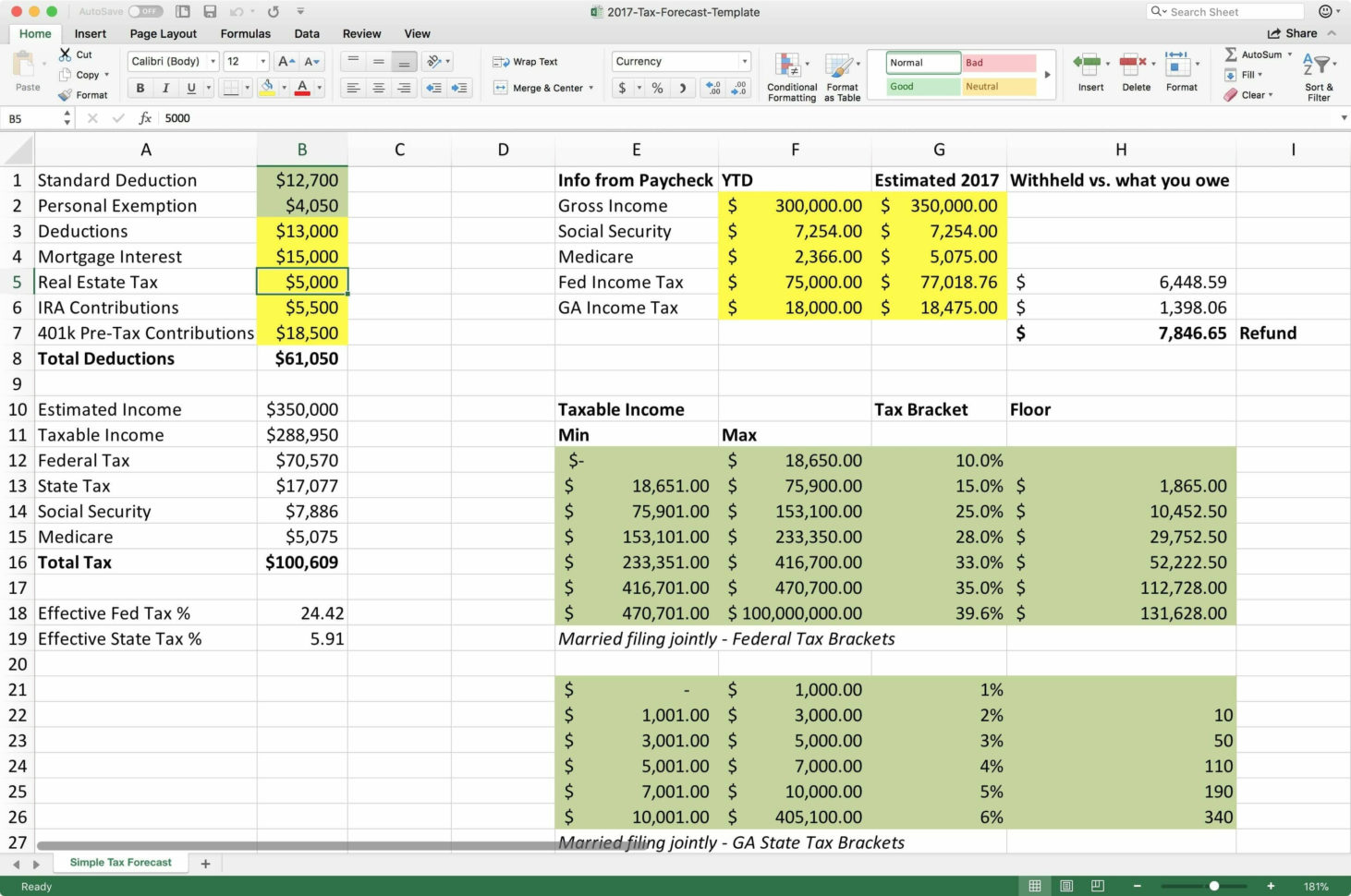

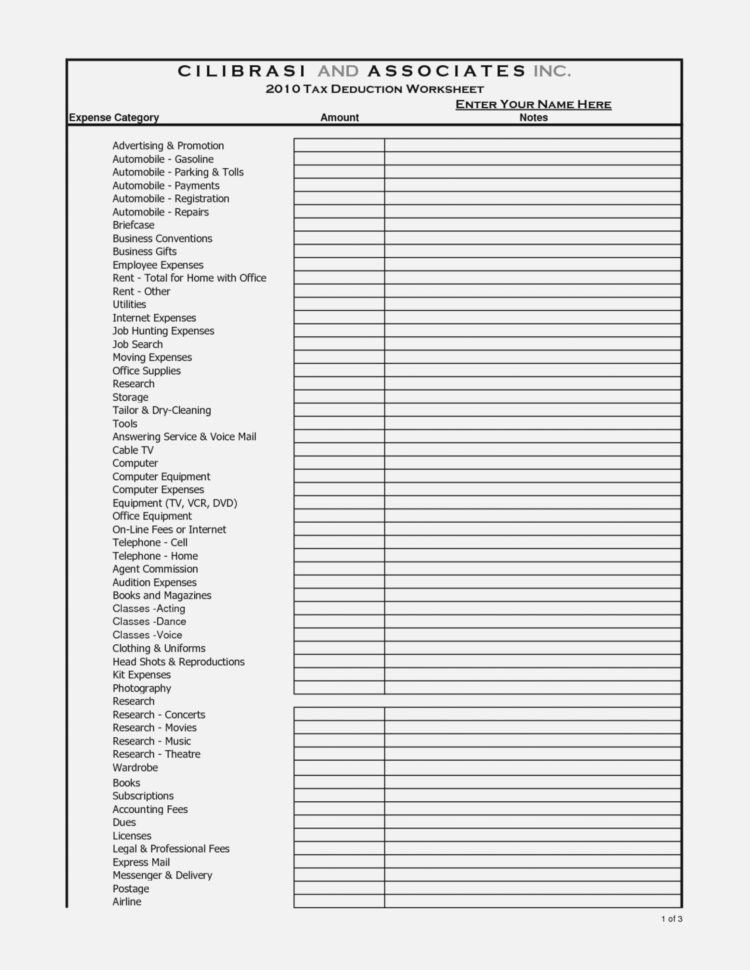

Small business tax deductions spreadsheet. If you use these categories in conjunction with your accounting software throughout the year, you’ll have a much easier time calculating your deductions come. Know what tax forms you need to file 3. Small business tax deductions checklist for 2023 (plus credits) over the next two weeks, business owners need to determine if their business is eligible or may.

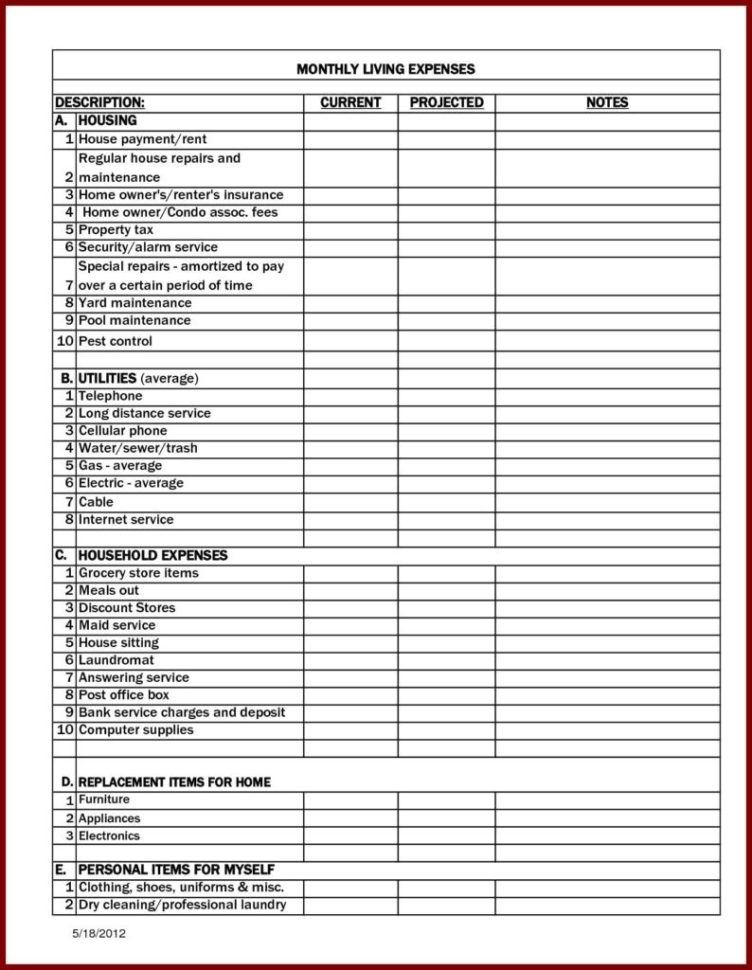

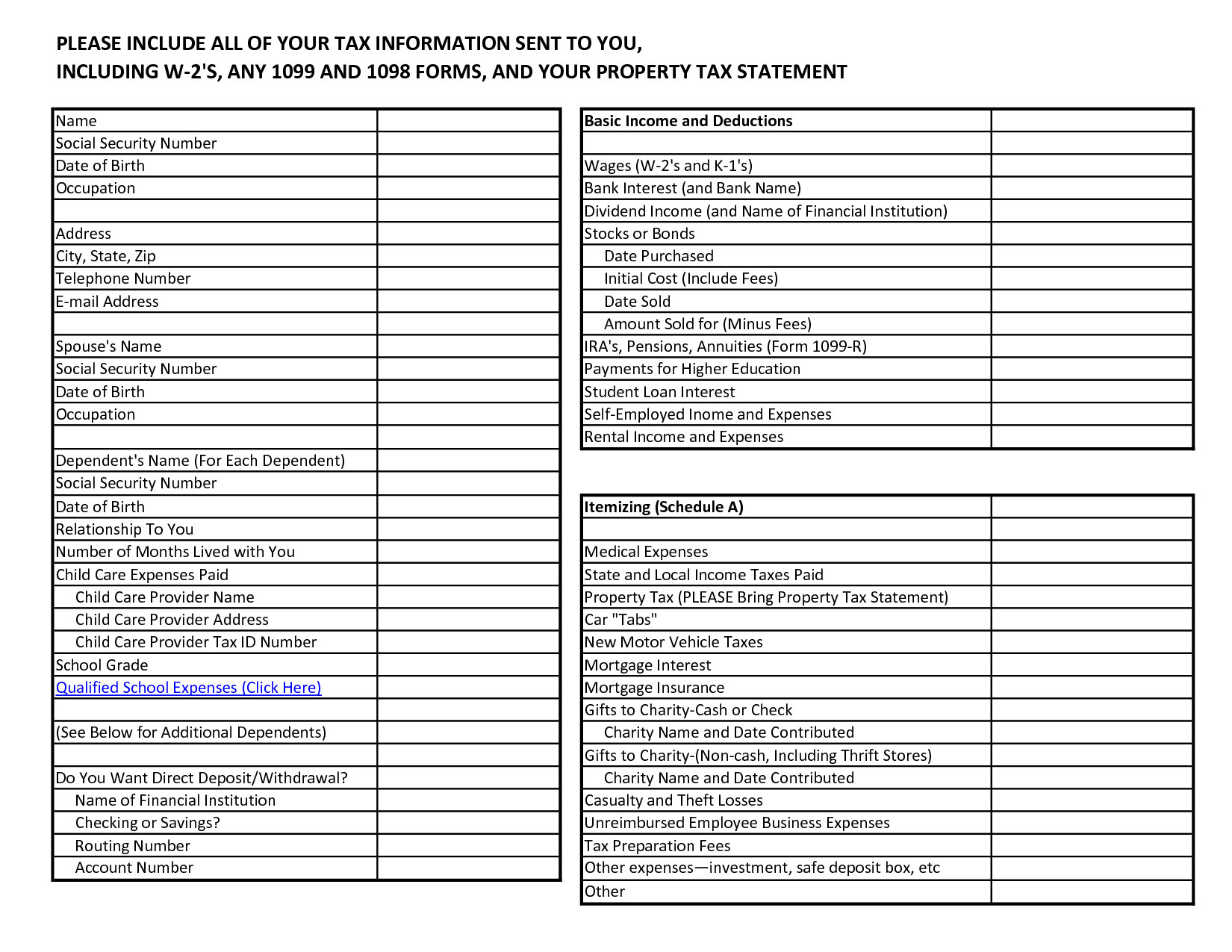

Gather the needed business tax return. Make your free small business tax worksheet make document what does a tax worksheet do? 23 free small business bookkeeping templates try smartsheet for free by andy marker | april 27, 2022 we’ve collected 23 of the top bookkeeping templates for.

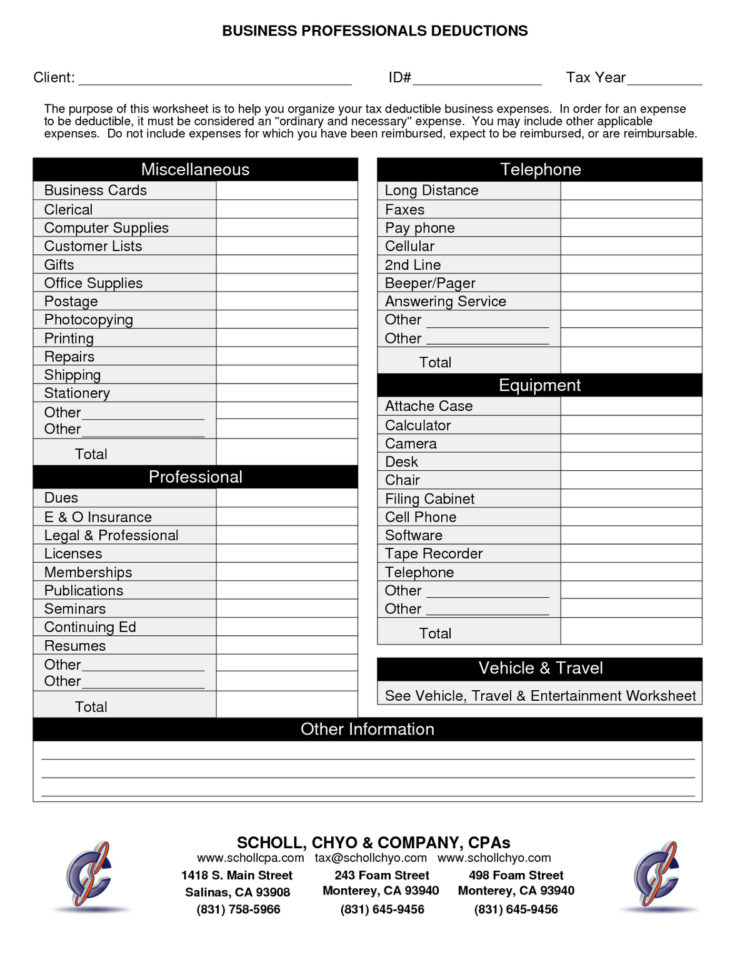

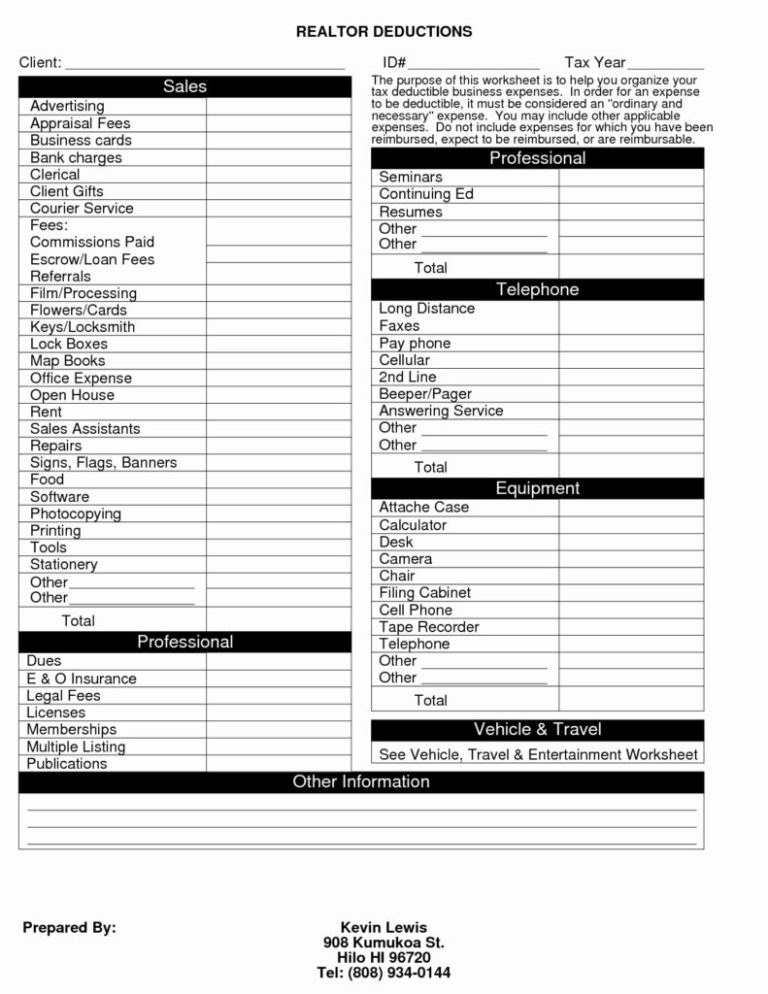

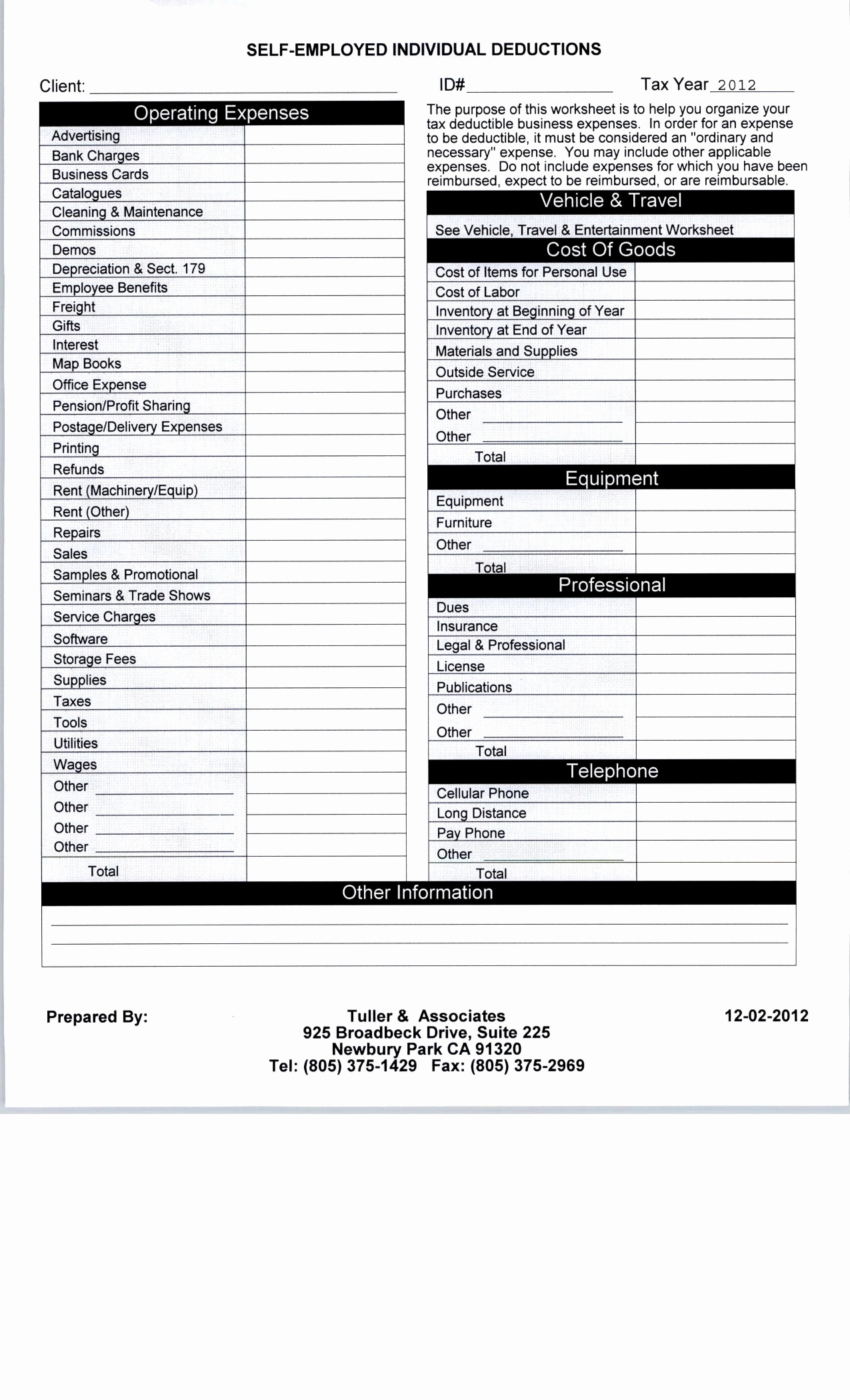

In order for an expense to be deductible, it must be considered an ordinary. If you're a freelancer, independent contractor, or small business owner who uses your home for business purposes, the home office tax deduction can be huge. Download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post.

A spreadsheet for business expenses is a standardized template that tracks and records a company’s expenses. Specifically, it details the “what,” “why,” “who,” and. Create a tax filing calendar 4.

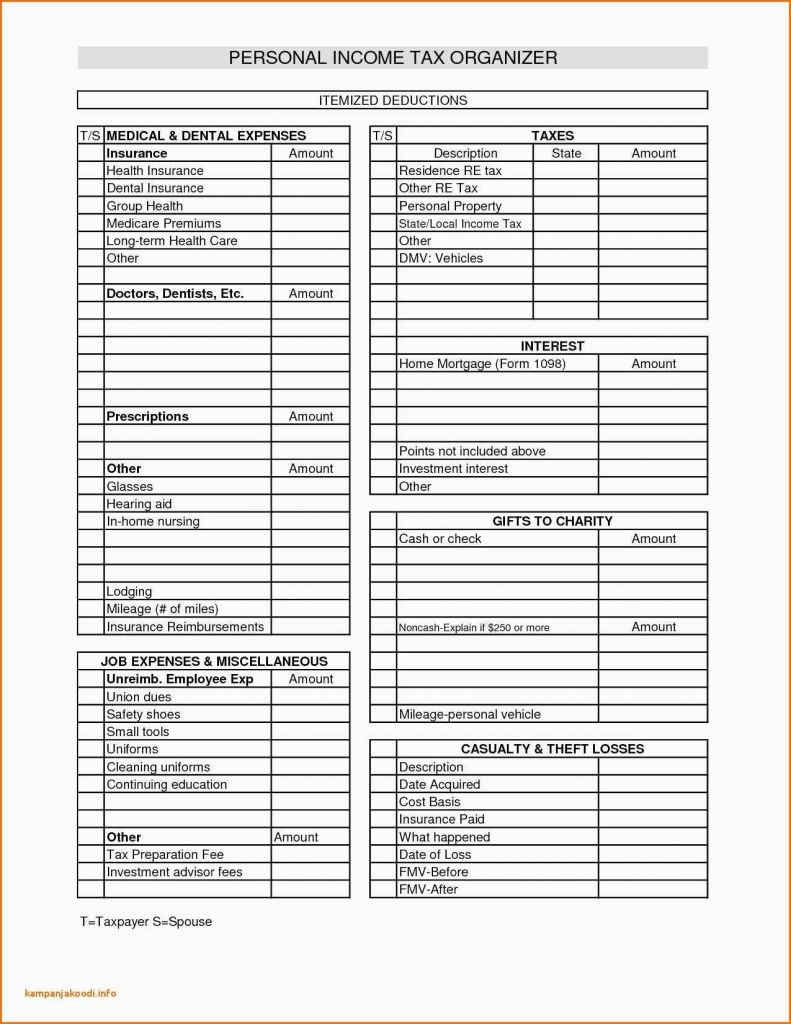

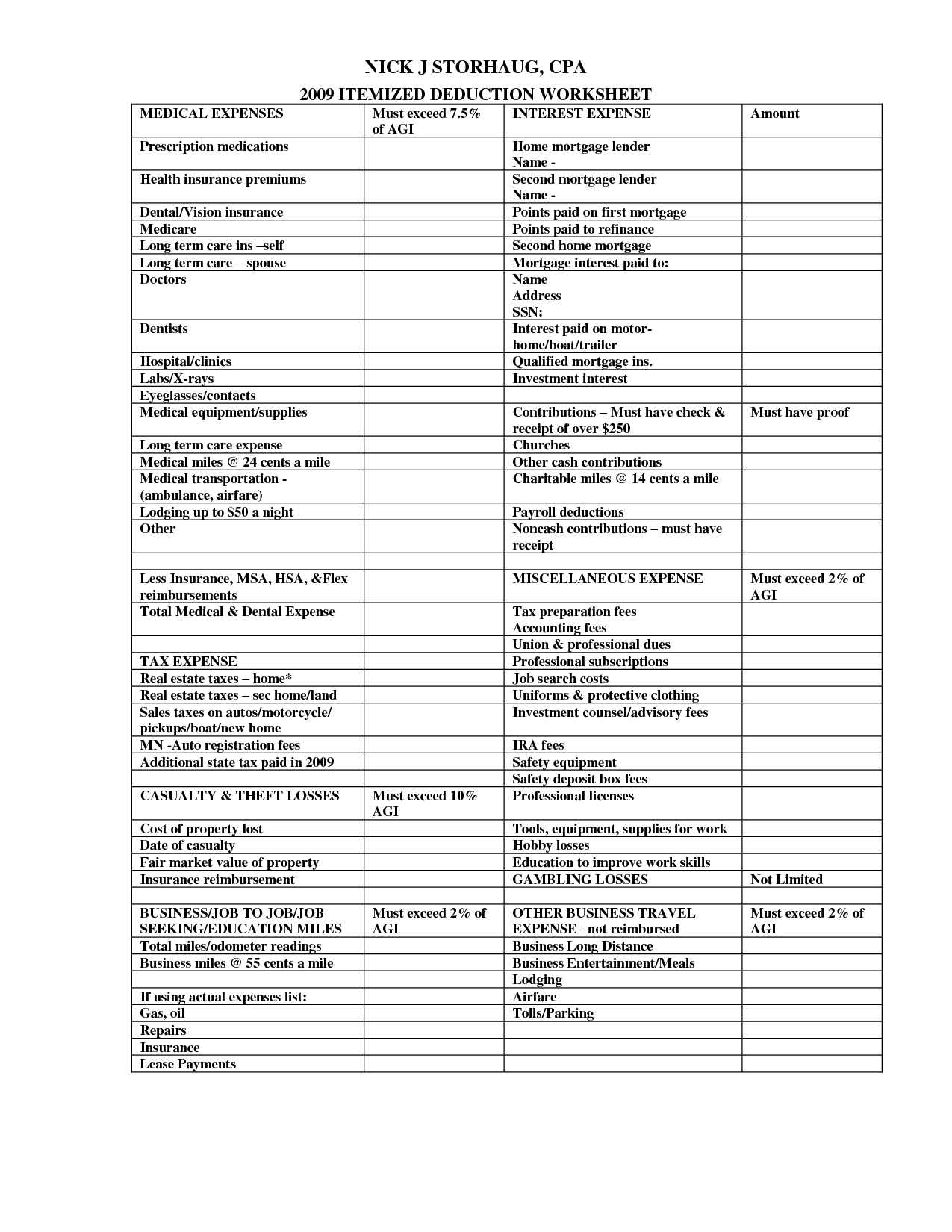

If you are required to itemize your deductions on your tax return, you can keep track of your expenses with a simple excel spreadsheet. Get our free printable small business tax deduction worksheet at casey moss tax, we have a free spreadsheet template that you can use to organize all. The home office deduction is one of the most significant tax benefits of running a small business out of your home.

With dedicated sections for various schedule c expense categories like advertising, car expenses, contract labor, office expenses, and more, you’ll never miss. How do i report independent contractor expenses? Know the types of small business taxes 2.

If you're facing an audit or filing taxes for the first time, complete our free.