Supreme Tips About Using Excel For Personal Finance

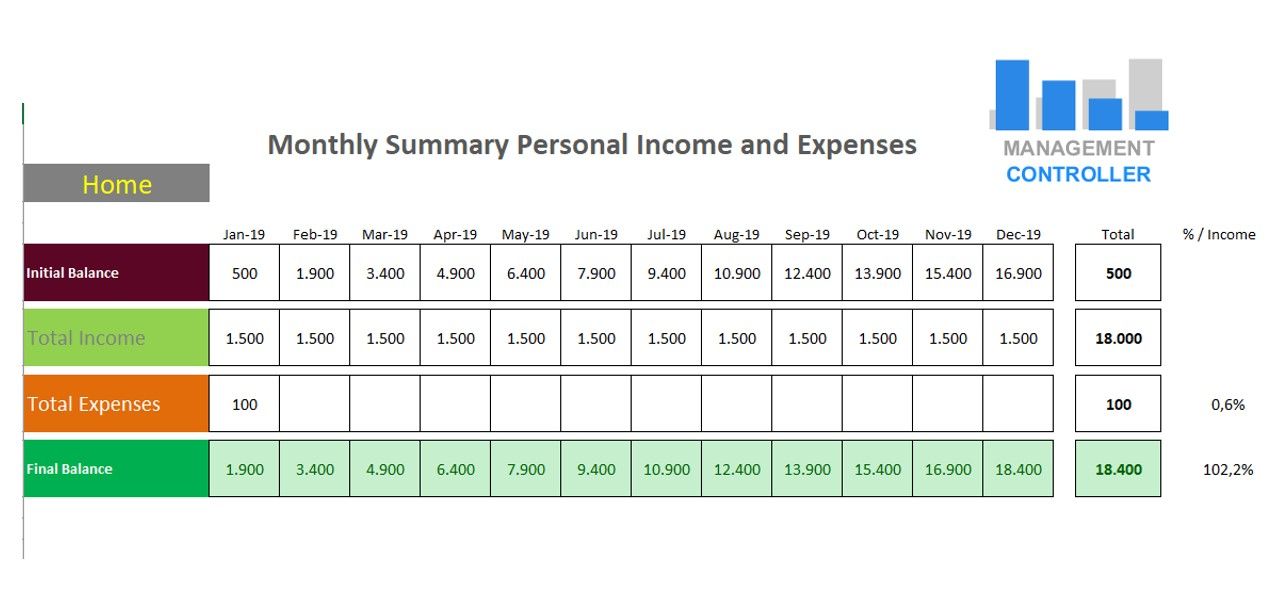

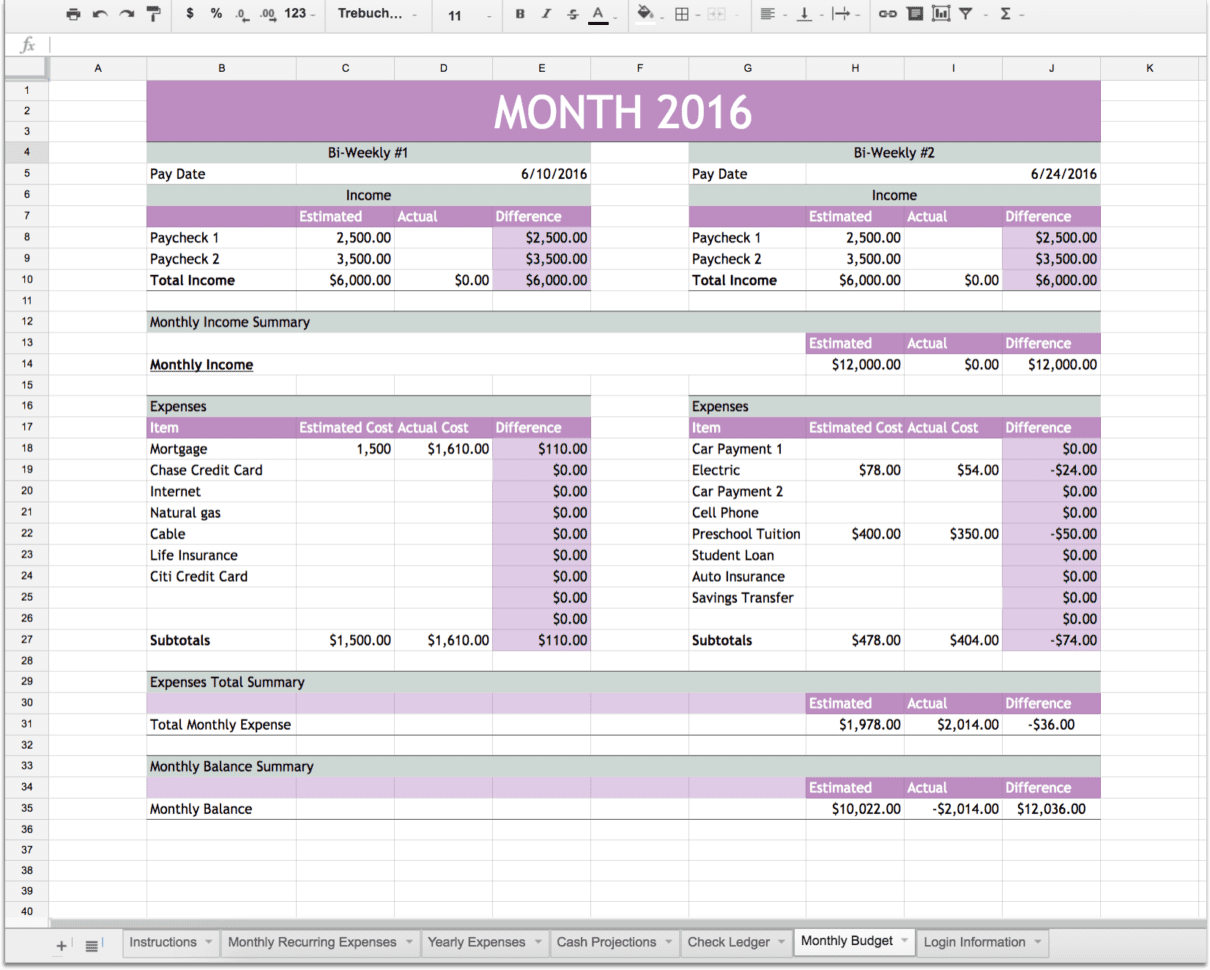

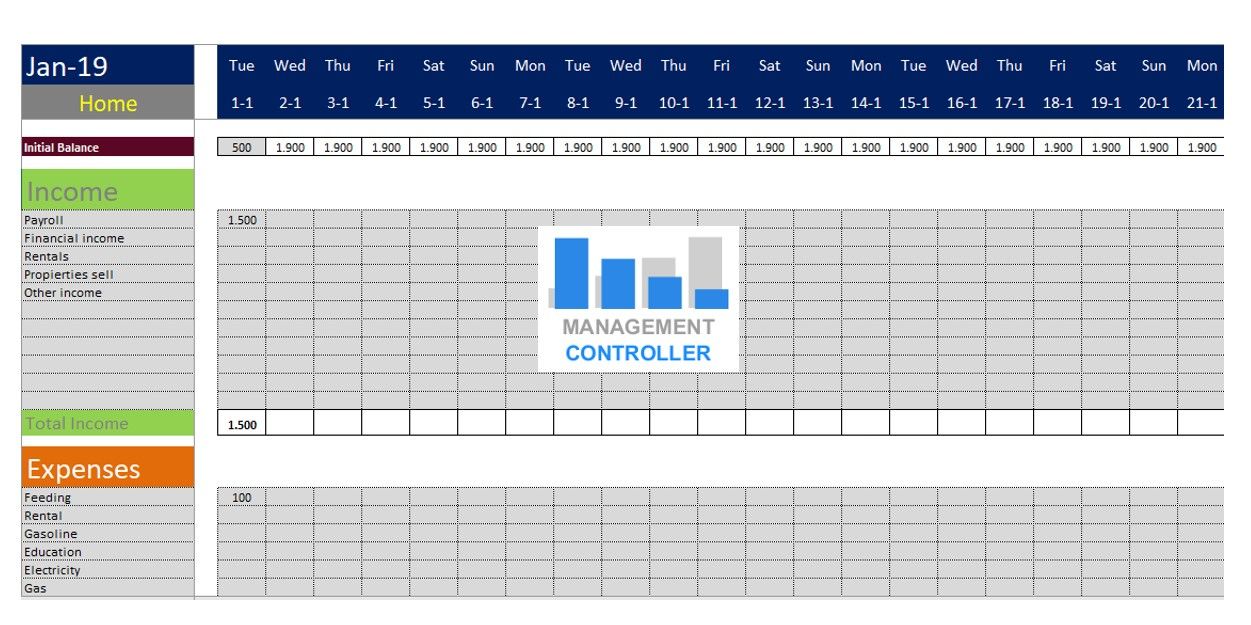

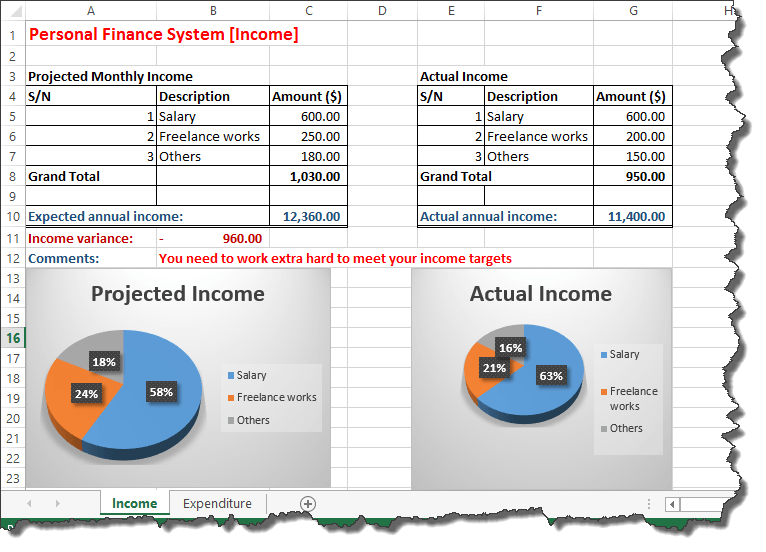

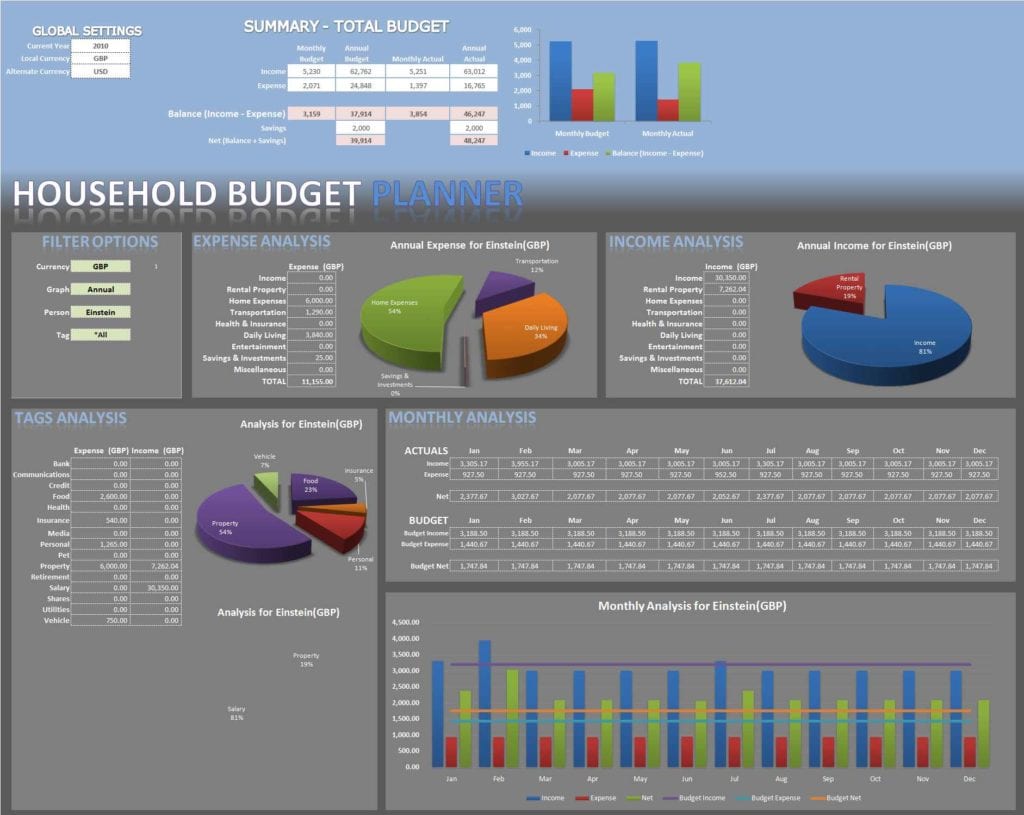

Start by creating a spreadsheet in excel or using a personal finance app to track your finances effectively.

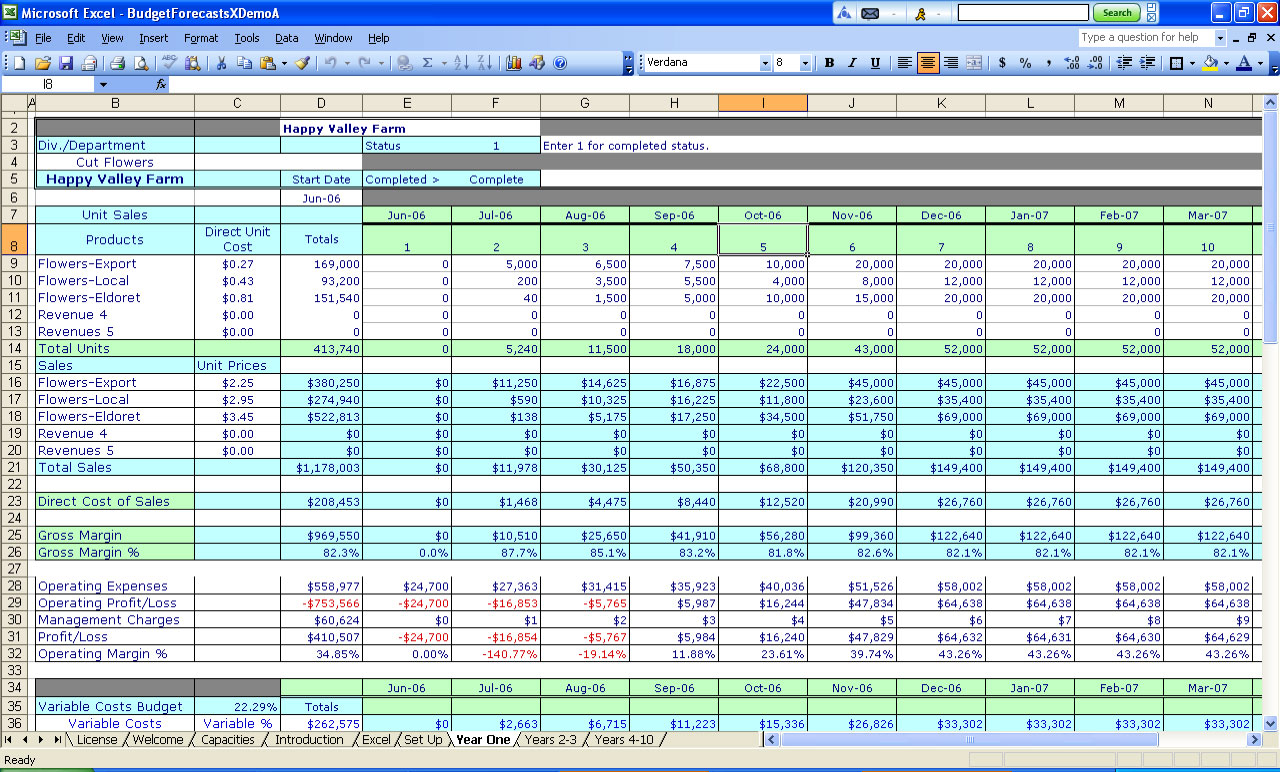

Using excel for personal finance. Prepare your budget step 4: Prefer to do things yourself? Focus on 20% of functions for 80% of tasks, honing key skills for.

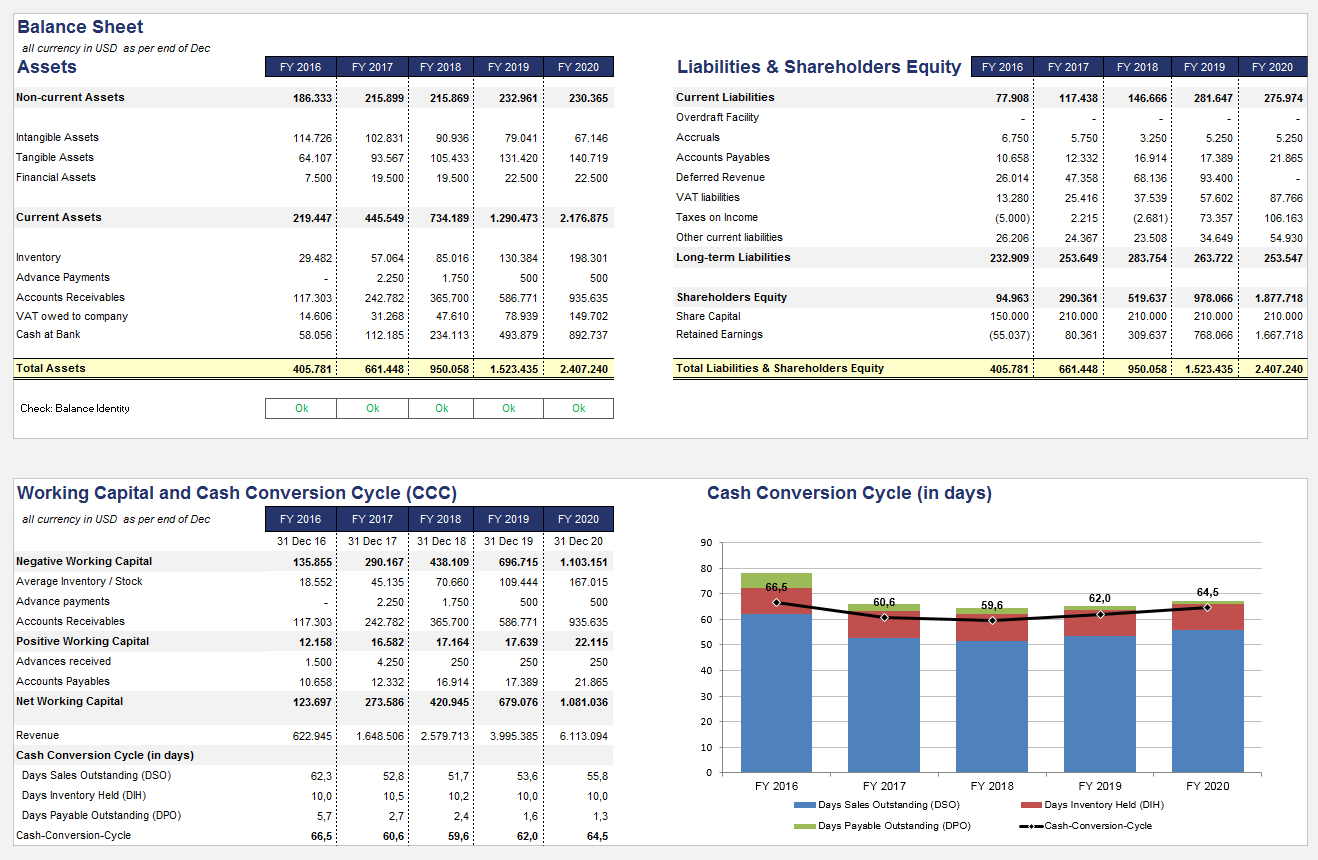

Define a named range for the subcategories step 3: With simple yet effective techniques, you can. This excel template can help you track your monthly budget by income and expenses.

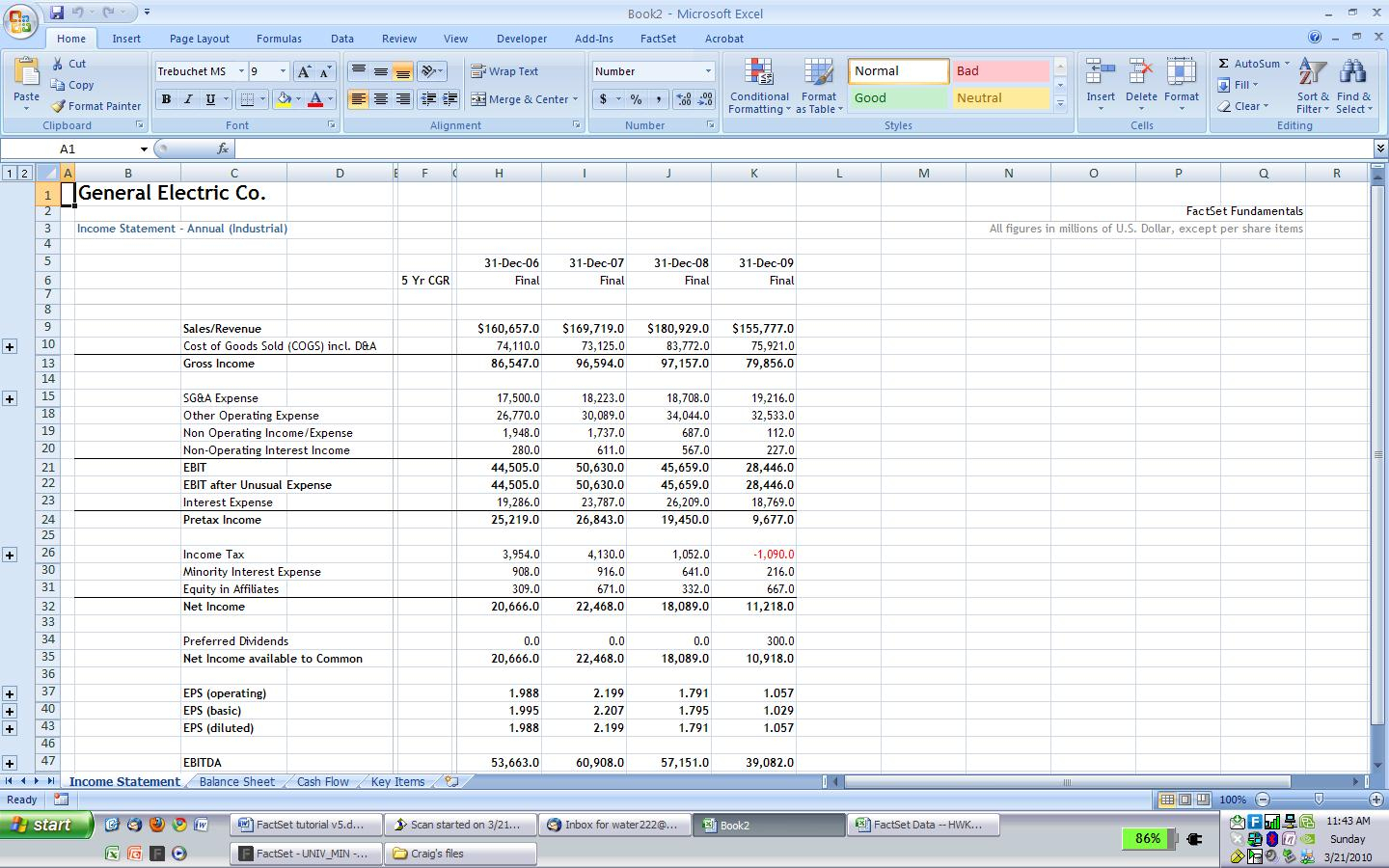

The sum function is one that you'll use the most when it comes to finances in excel. It allows you to add. Excel is vital for finance, offering data manipulation and visualization for analysis and modeling.

Keeping track of your income, expenses, and savings. Excel allows you to create a customizable budget template. Excel formulas and budgeting templates can help you calculate.

From there, the workbook can. Diy with the personal budget template. How to create ultimate personal budget in excel the office lab 215k subscribers subscribe subscribed 45k share 1.9m views 1 year ago #personalbudget.

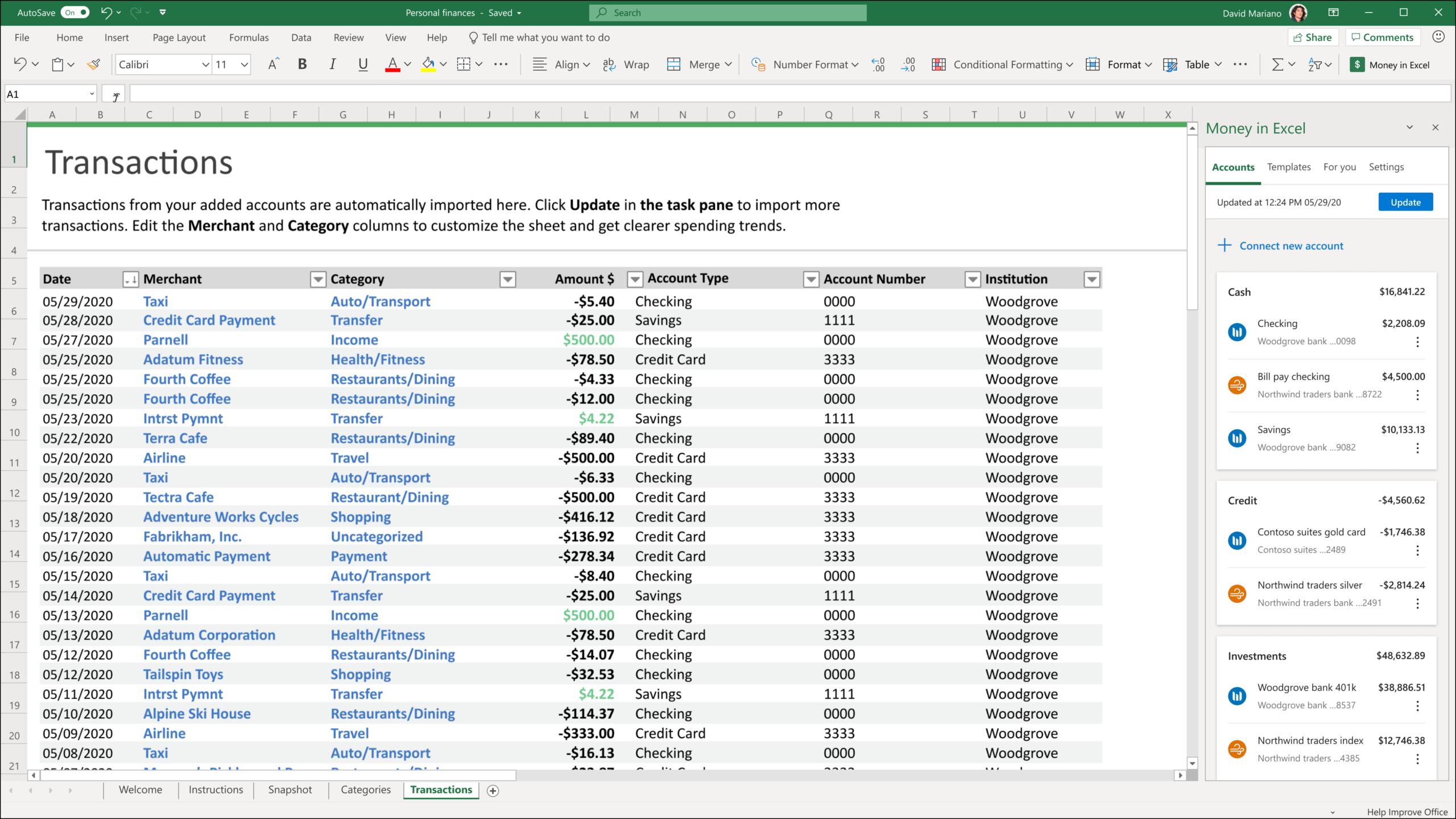

Connect your financial accounts next, you need to. If you’re a current microsoft 365 personal or family. Add and subtract income and expenses:

Create a customizable, personal monthly budget excel template from scratch. Personal finances are a matter of organization and excel is a tool that makes it much easier. Organize your tracker by creating separate sheets for.

Managing personal finances can be a challenge, especially when trying to plan your payments and savings. Identify the types of income and expenses you have step 2: In this article, we will explore how we can leverage on excel to elevate your personal finance management game.

Learn to manage your daily personal finances with microsoft excel.