Here’s A Quick Way To Solve A Tips About Vat Reconciliation Excel Template South Africa

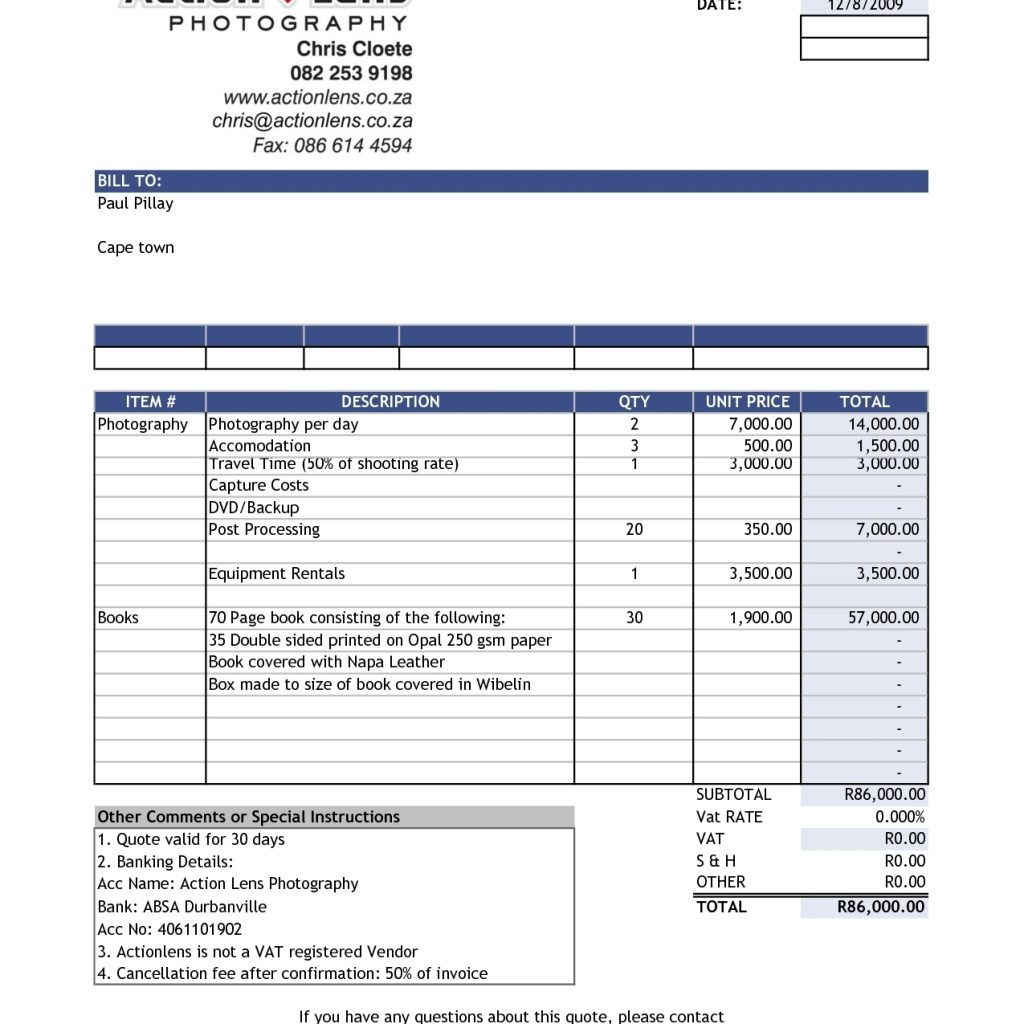

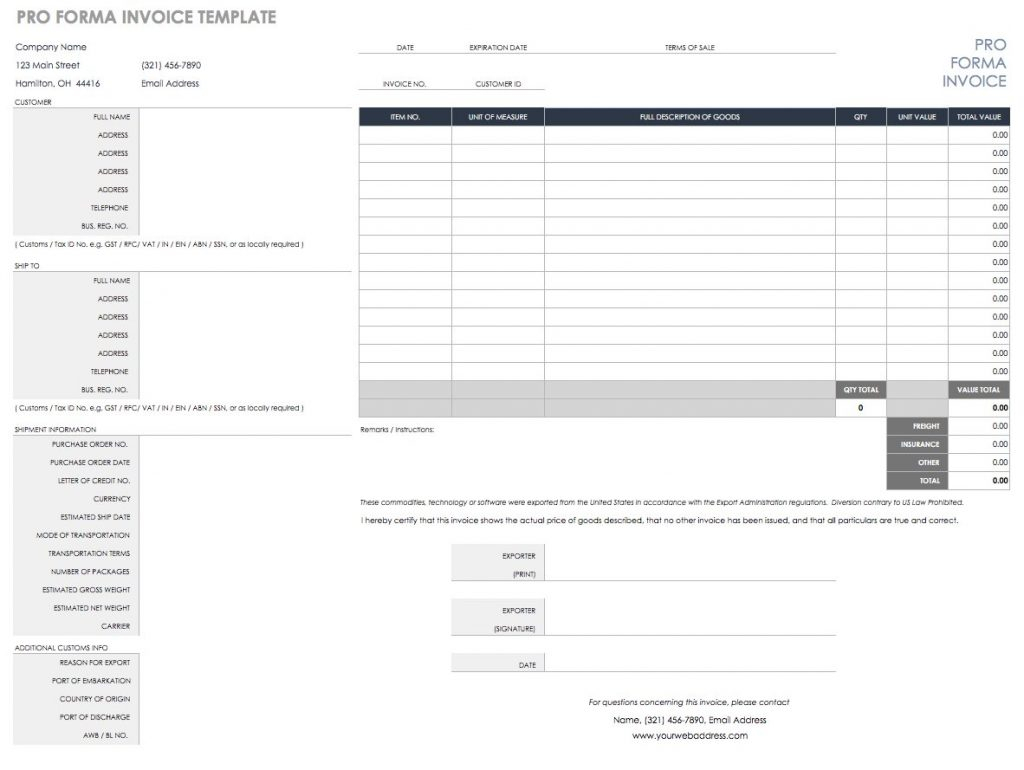

South african tax invoice template (sales) (south african tax billing format (sales)).

Vat reconciliation excel template south africa. Expenses and credit notes applying to. Turnover reconciliations are becoming standard practiceduring vat audits. Download a free invoice template that is perfect to use in excel designed for businesses in south africa.

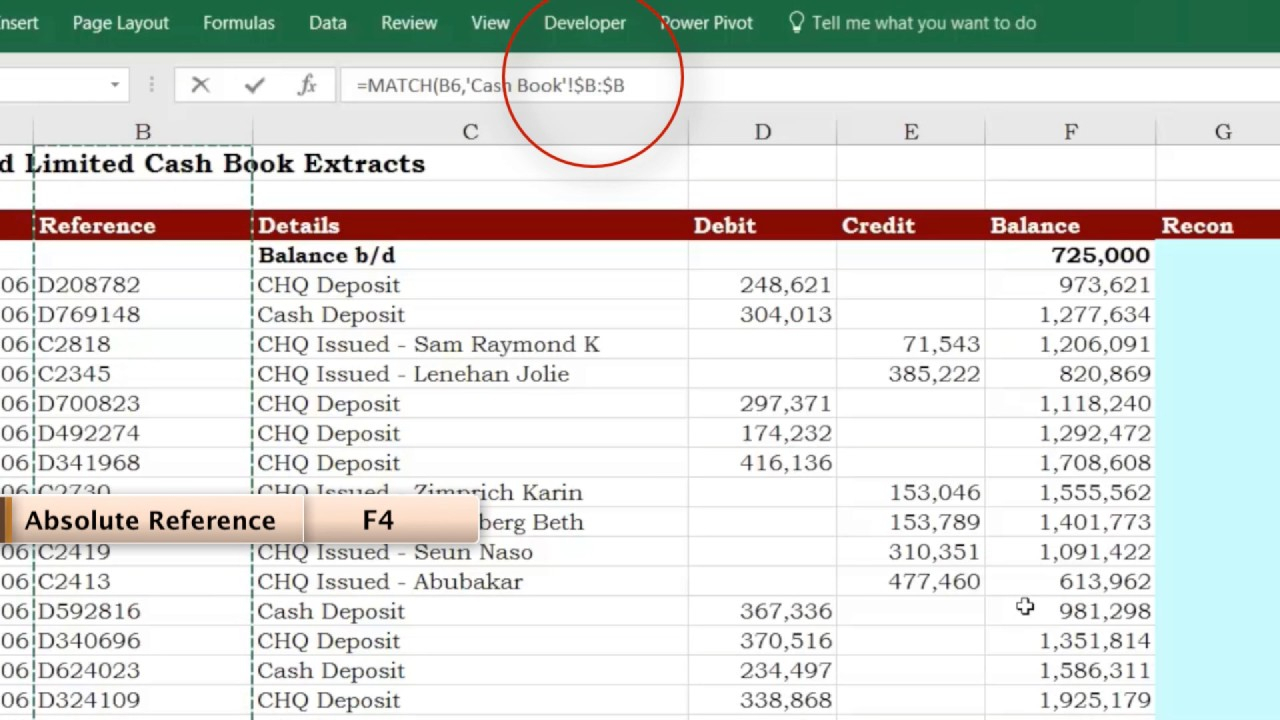

R49.00 add to cart back title / topic vat reconciliations outcomes of topic after studying the topic related to vat reconciliations you should be able to: Make sure you have installed one of them. I) select “returns”, then “returns issued” and “request vat control table”.

Add discounts, add more fields if applicable and print, save as pdf or email the. We created a collection of making tax digital (mtd) spreadsheet templates to make. Free south africa invoice template with vat.

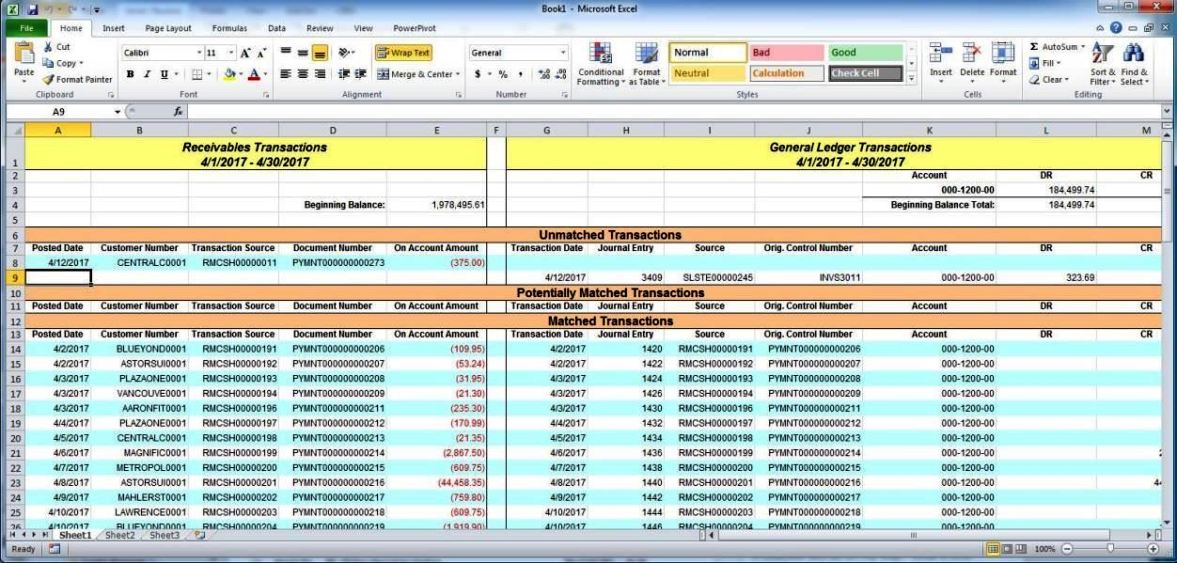

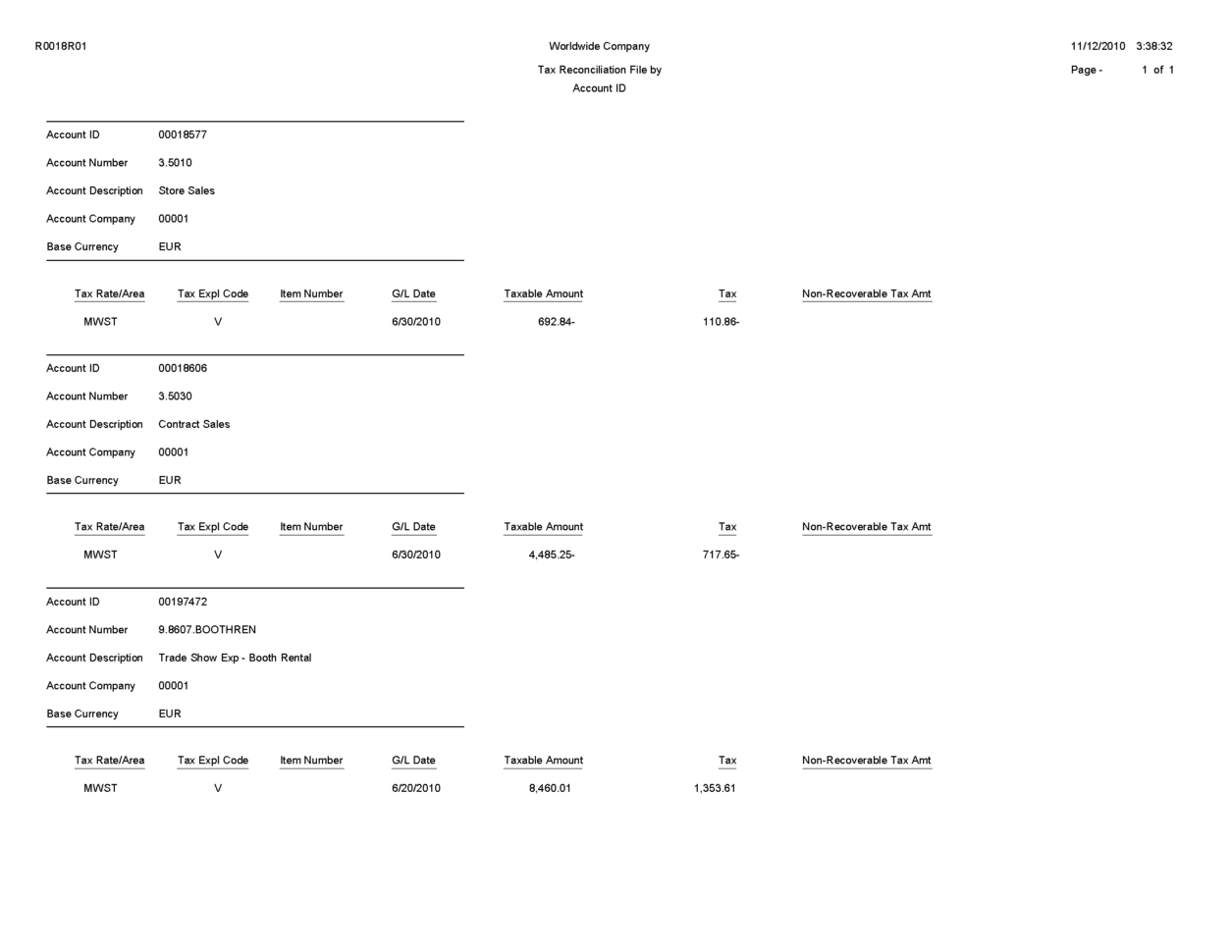

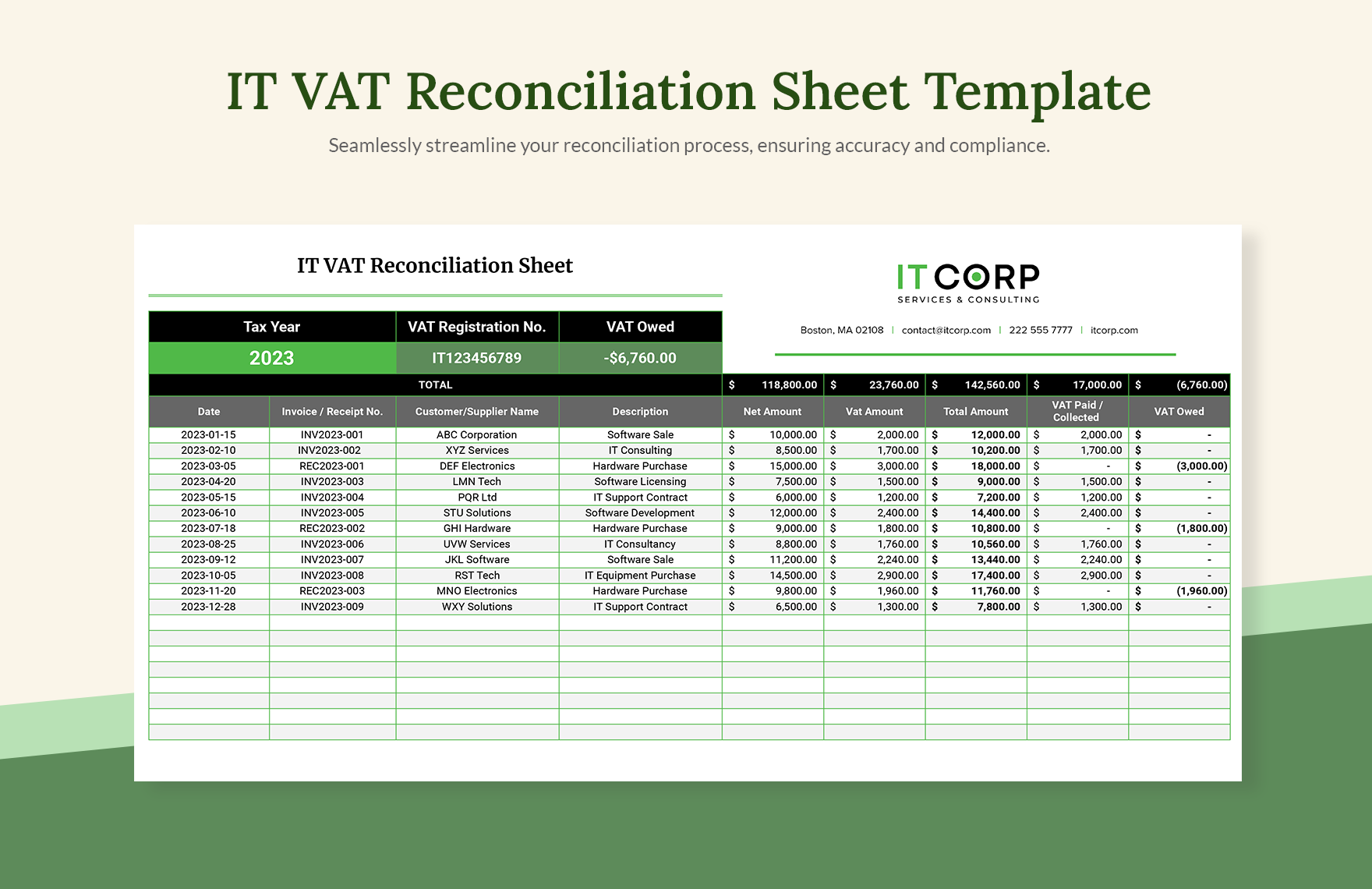

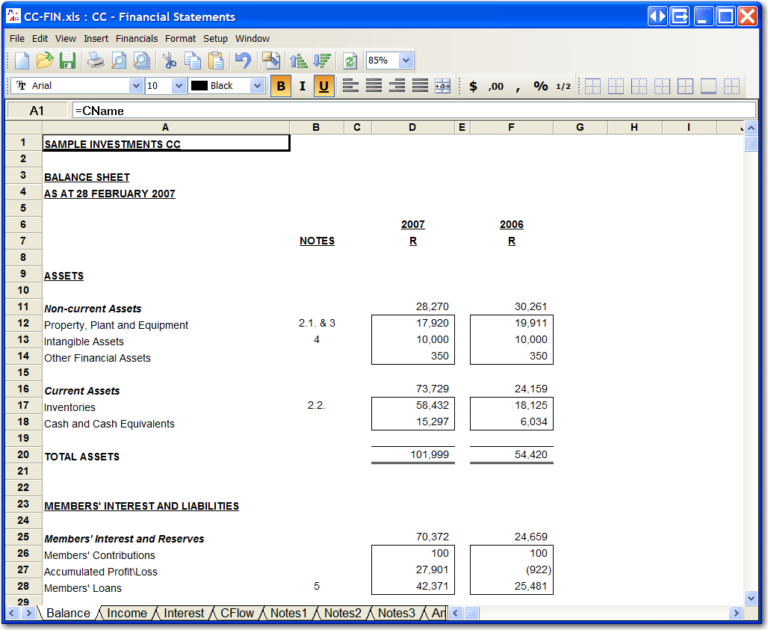

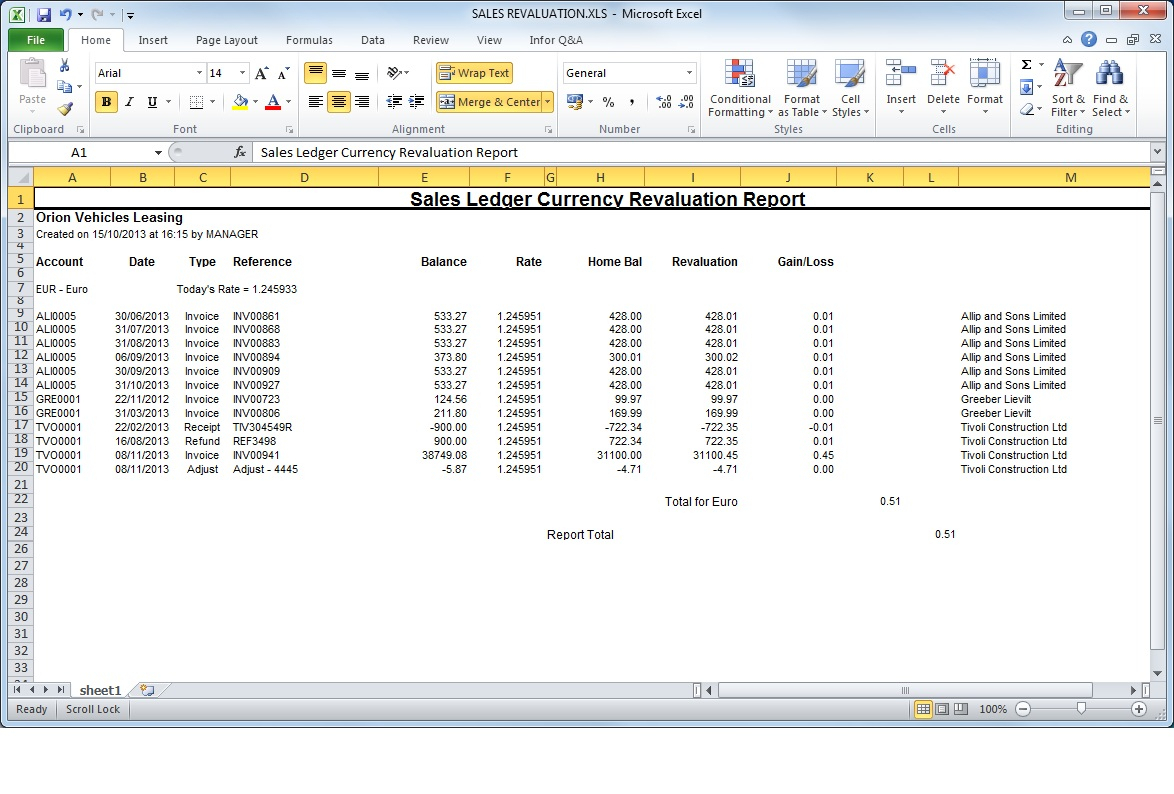

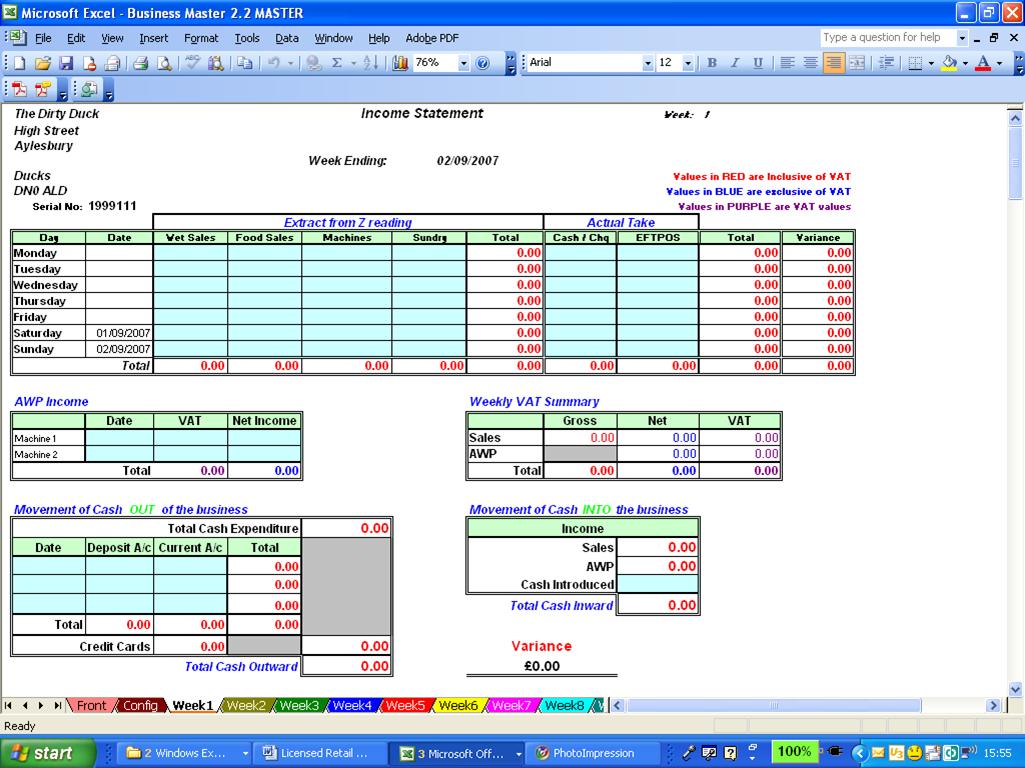

January 26, 2021 after the budget presentation by finance minister tito mboweni on 24 february 2021, our annual south african tax spreadsheet calculator 2021/ 2022 is. The vat turnover reconciliation aims to reconcile turnover as per the annual financial statements (afs) to the total output tax declared over the same period. Here is the vat recon, the overall idea is to track cumulative income and expenses and the vat paid or claimed thereon.

This allows you to check for any unfiled or unpaid. 5 view vat filing control table a) to view the vat filing control table: The template works with both the microsoft store edition and the desktop edition of the app.

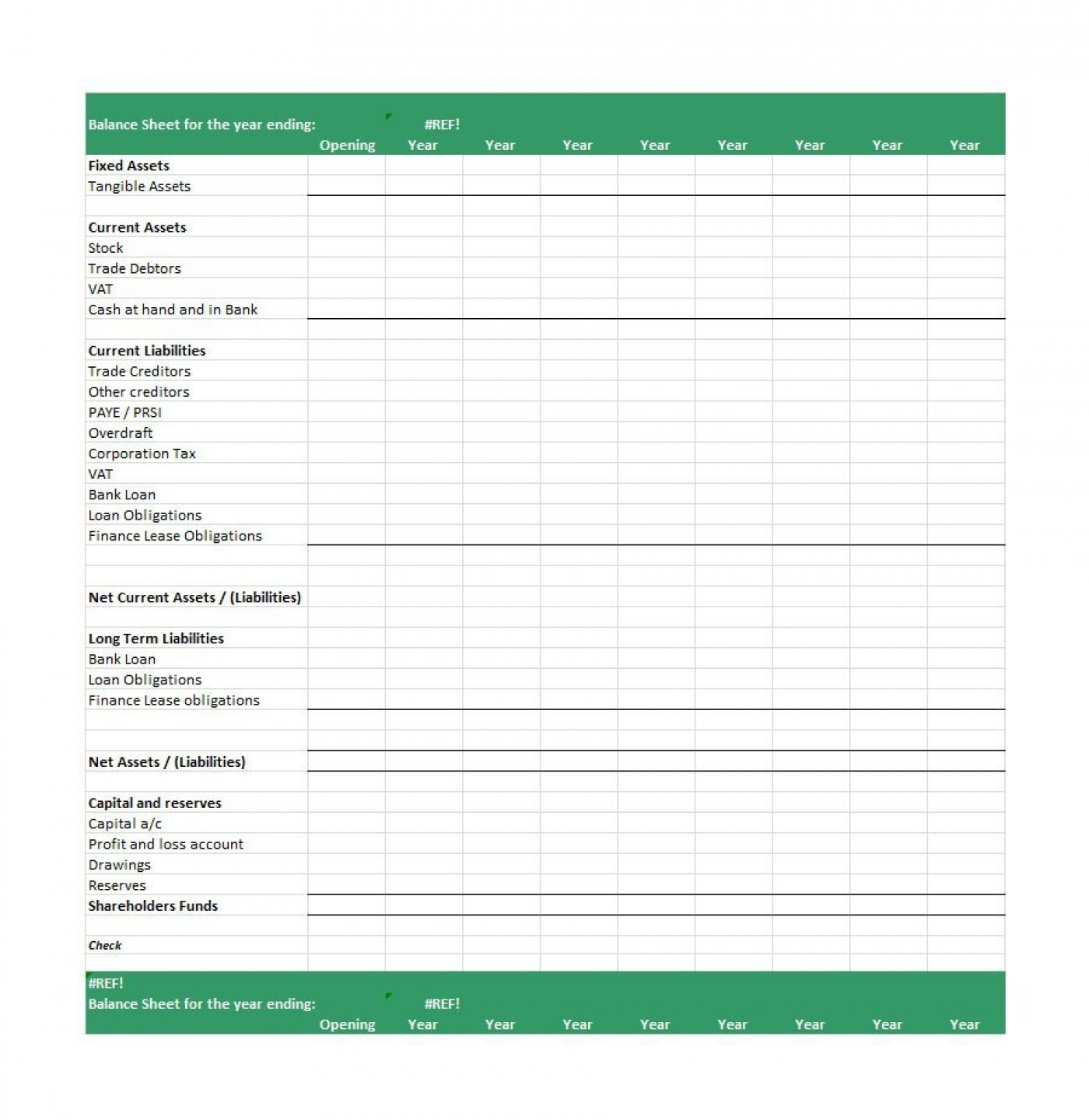

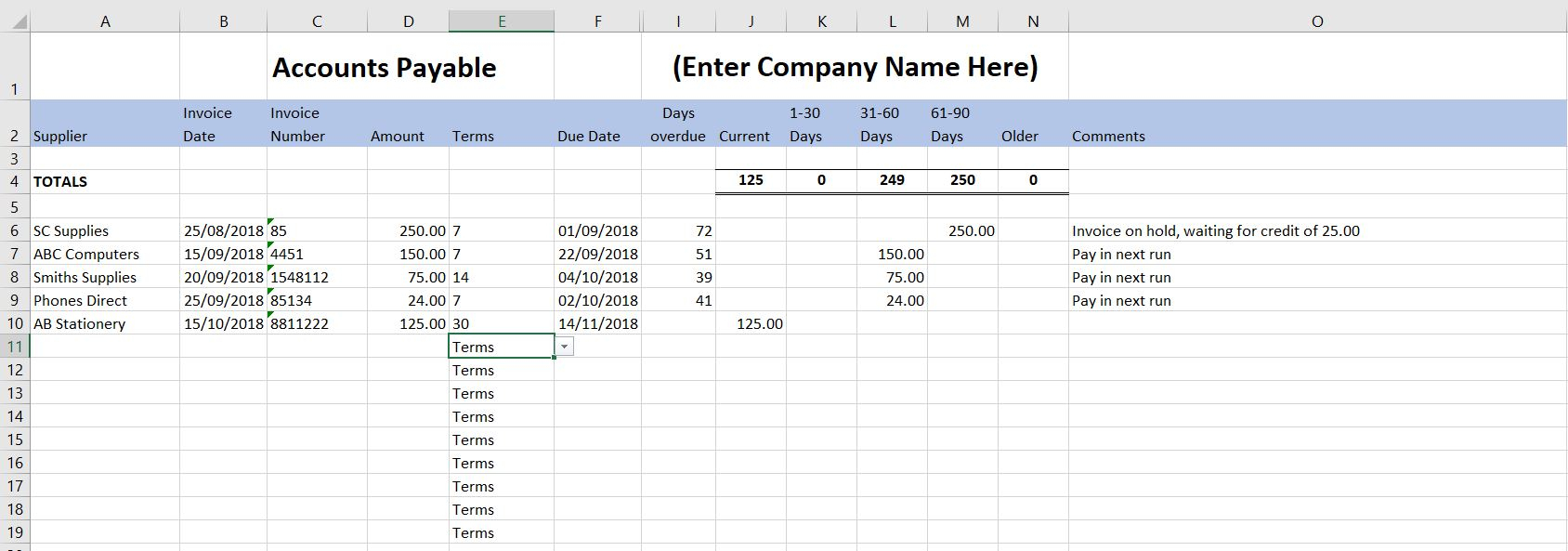

Breakdown of the vat amount per. Download our free template in excel / pdf format: Develop proficiency in using excel spreadsheets for bookkeeping.

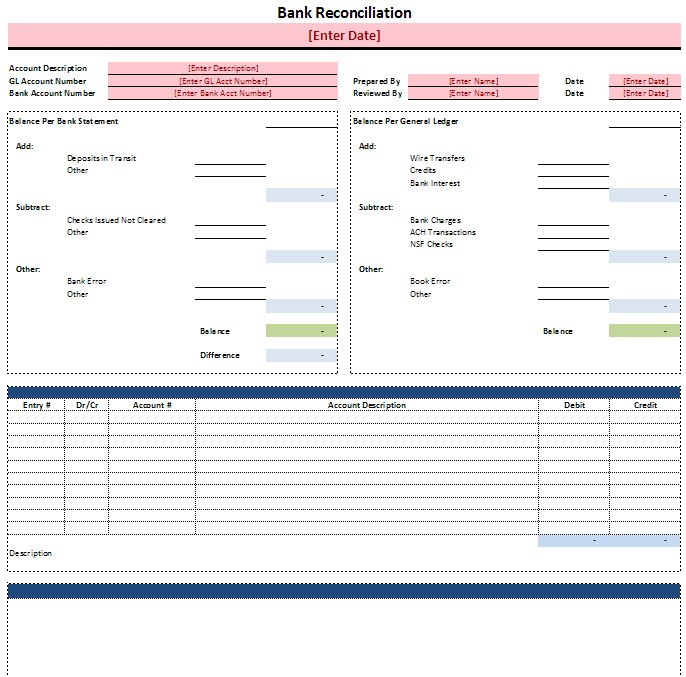

Free mtd vat spreadsheet templates for excel anna’s free templates for vat filing. Regular reconciliation between the vat control account and vat returns should be performed to ensure accuracy. Sars the process of vat reconciliation in south africa might be likened to a meticulous financial balancing endeavor, aimed at assuring precise alignment of all.

Bindings of the transactional legs against the relevant vat legs 3. Gain a clear view of your. Learn the fundamentals of bank reconciliation and vat codes, rates, and regulations.

Tax authorities requesting source erp data. Add or edit the taxes from the set taxes button. Use this report to compare vat on your standard scheme vat returns with vat on transactions for the same period.

Vat control account reconciliation: